work in process inventory formula

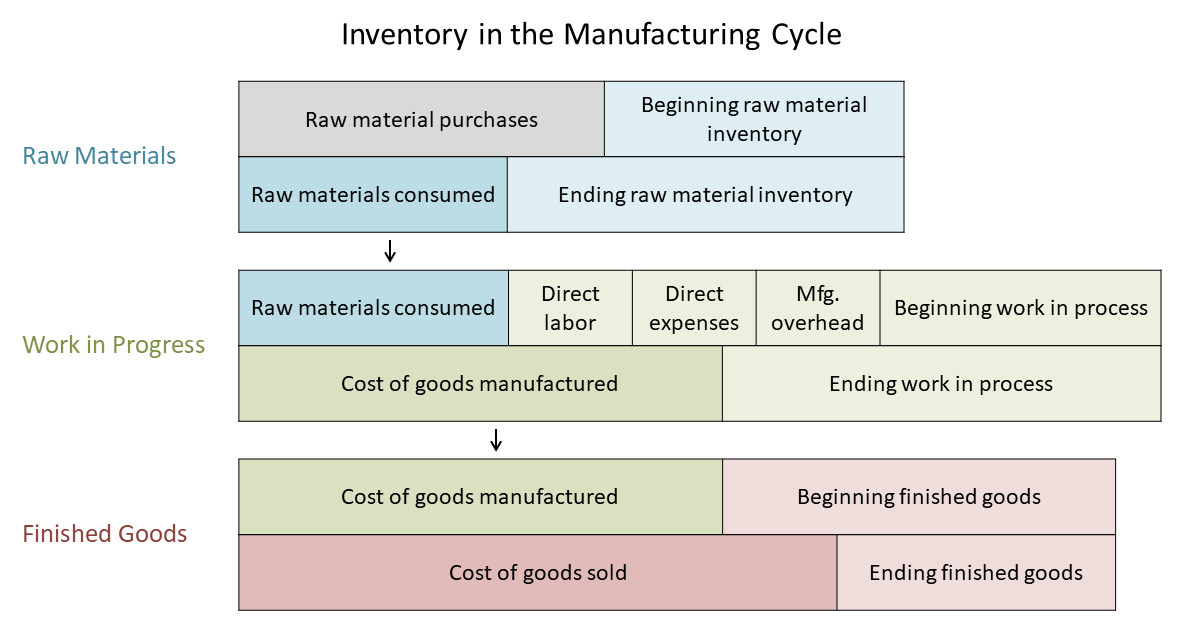

Beginning work in process amount manufacturing costs cost of manufactured goods. Beginning WIP Inventory Manufacturing Costs Cost of Finished Goods Ending WIP Inventory.

Reorder Point Formula Know When To Reorder

Some inventory might have one stage of machining done and other inventory might have all but one stage of machining done.

. Since every manual cycle time must be within takt by. If you have a WIP inventory it is usually considered an asset. The cost of work-in-process typically includes all of the raw material cost related to the final product since raw materials are usually.

Mar 08 2022 middot your wip inventory formula would look like this 10 000 300 000 ndash 250 000 60. Heres how youll need to do it. The WIP figure reflects only the value of those products in some intermediate production stage.

WIP b beginning work in process. The WIP figure indicates your company has 60000 worth of inventory thats neither raw material nor finished goodsthats your work in process inventory. WIP e WIP b C m - C c.

WIP or work in process inventory refers to the total cost of unfinished goods currently still in production. Work-in-process inventory is materials that have been partially completed through the production process. Keep in mind this value is only an estimate.

Work-in-Process Inventory Formula. Ending WIP Beginning WIP Costs of manufacturing - costs of goods produced. You might have always been thinking about how to find work in process inventory.

It is a common term used in the production and supply chain management of e-commerce businesses that manufacture their products. Work in Process Inventory Formula. How do you calculate work in process inventory.

Work in process inventory and work in progress inventory are interchangeable phrases for the most part. The work in process formula is the beginning work in process amount plus manufacturing costs minus the cost of manufactured goods. Once you know your beginning WIP inventory manufacturing costs and COGM you can start to use the WIP inventory formula.

The manufacturing costs incurred in this quarter are 200000 and the cost of manufactured goods is 100000. The last quarters ending work in process inventory stands at 10000. Your WIP inventory formula would look like this.

The beginning WIP inventory cost refers to the previous accounting periods asset section of the balance sheet. An important note to consider is that work in process inventory can vary greatly. To calculate the WIP inventory ie work in process inventory you need to use the following work in process inventory formula.

WIP is calculated as a sum of WIP inventory total direct labor costs and allocated overhead costs. Total Cost of Manufacturing Beginning Work in Process Inventory Ending Work in Process Inventory Cost of Manufactured Goods. It is the total costs transferred from work-in-process inventory to final goods inventory.

These items are typically located in the production area though they could also be held to one side in a buffer storage area. What is Work-in-Process WIP. Work-in-process WIP inventory consists of raw material direct labor and overhead costs.

Beginning WIP Manufacturing costs - Cost of goods manufactured Ending work in process. Ad See the Inventory Tools your competitors are already using - Start Now. Add the value of goods added to work-in-process during the previous period to the beginning work-in-process inventory in the previous period.

Therefore the formula from which a business can calculate their COGM using work in process inventory costs can be displayed like this. And C c cost of goods completed. Standard work in process or SWIP is the minimum necessary in-process inventory work in process or WIP to maintain Standard Work.

WIP Work In Process Inventory is the total cost of unfinished goods currently in the production process. In this example the beginning work in process total for June is 50000 the manufacturing costs are 200000 and the cost of goods. How Do You Calculate Work In Process Inventory.

Abnormal loss- Physical units produced are multiplied by the degree of completion. At the end of the production process work-in-process is transferred to the finished goods inventory. Take a look at how it looks in the formula.

Beginning WIP Inventory Production Costs Finished Goods Ending WIP Inventory. Read reviews on the premier Inventory Tools in the industry. To calculate beginning inventory subtract the amount of inventory purchased from your result.

The difference between the sum of the beginning work in process and the costs of manufacturing is the ending work in process. Under this method the cost of completed units is calculated by multiplying production expressed in terms of equivalent units. Use the work in process formula to get an accurate estimate.

Regardless of the size and complexity of a manufacturers raw and finished goods where many factories struggle is with the taking and accounting of WIP inventory. This excludes the value of raw materials not yet incorporated into an. In this equation WIP e ending work in process.

Assume Company A manufactures perfume. In formulas 2 3 and 4 there is no manual cycle time included in the calculation. Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs- Ending WIP Inventory.

Abnormal gain- Physical units 100 complete. Work In-process Inventory Example. In this case for example consider any manufactured goods as work in process.

Ending work-in-process beginning work-in-process all manufacturing costs during the period - cost of. How do I account for work in progress inventory. Work in process inventory 60000.

The calculation of ending work in process is. As raw materials and components are. Work in process inventory includes all raw goods production expenses and labor costs associated with producing merchandise inventory.

The formula for ending work in process is relatively simple. Works in process WIP are included in the inventory line item as an asset on your balance sheet. 10000 300000 250000 60000.

WIP or Work in Progress is a part of a companys overall inventory that has begun being processed but is not yet finished. Once you have all three of these variables the formula for calculating WIP inventory is. It consists of items that are yet to be.

Beginning WIP Inventory Manufacturing Costs COGM Ending WIP Inventory What Does Work In Process Inventory Mean. The amount of ending work in process must be derived as part of the period-end closing process and is also useful for tracking the volume of production activity. C m cost of manufacturing.

This is because rule 1 takes care of that. If your head is spinning with all these figures dont worry. Example of the Ending Work in Process Calculation.

No more no less.

Supply Chain Mapping The How To Guide With Examples Supply Chain Infographic Supply Chain Supply Chain Logistics

Wip Inventory Definition Examples Of Work In Progress Inventory

Average Inventory Formula How To Calculate With Examples

Work In Process Wip Inventory Youtube

Cost Of Goods Manufactured Formula Examples With Excel Template

Sales Cost Of Goods Sold And Gross Profit Cost Of Goods Sold Cost Of Goods Cost Accounting

Inventory Tracking Template Calculates Running Tally Of Etsy Inventory Management Templates Spreadsheet Template Excel

How To Print Barcodes With Excel And Word Excel Barcode Labels Grocery Checklist

The Sum Of The Years Digits Method Of Depreciation Accounting Education Learn Accounting Sum

How To Calculate Cost Of Manufacturing Apparel Products Online Clothing Study Budgeting Worksheets Manufacturing Cost

All You Need To Know About Wip Inventory

What Is Selection Ratio Definition Formula Applicability Exceldatapro Federal Income Tax Adjusted Gross Income Dearness Allowance

Supply Chain Mapping The How To Guide